Total Inventory Cost Formula

They offer a 2 discount if the customer pays with cash. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity.

Solved Please Answer Question 3 4 Amp 5 3 For Chegg Com

Total Cost 20000 6 3000.

. Cost of Goods Sold Formula Example 1. Year 1 Costs 20k. These assets are calculated with the opening and closing of the total assets in the businesss balance sheet.

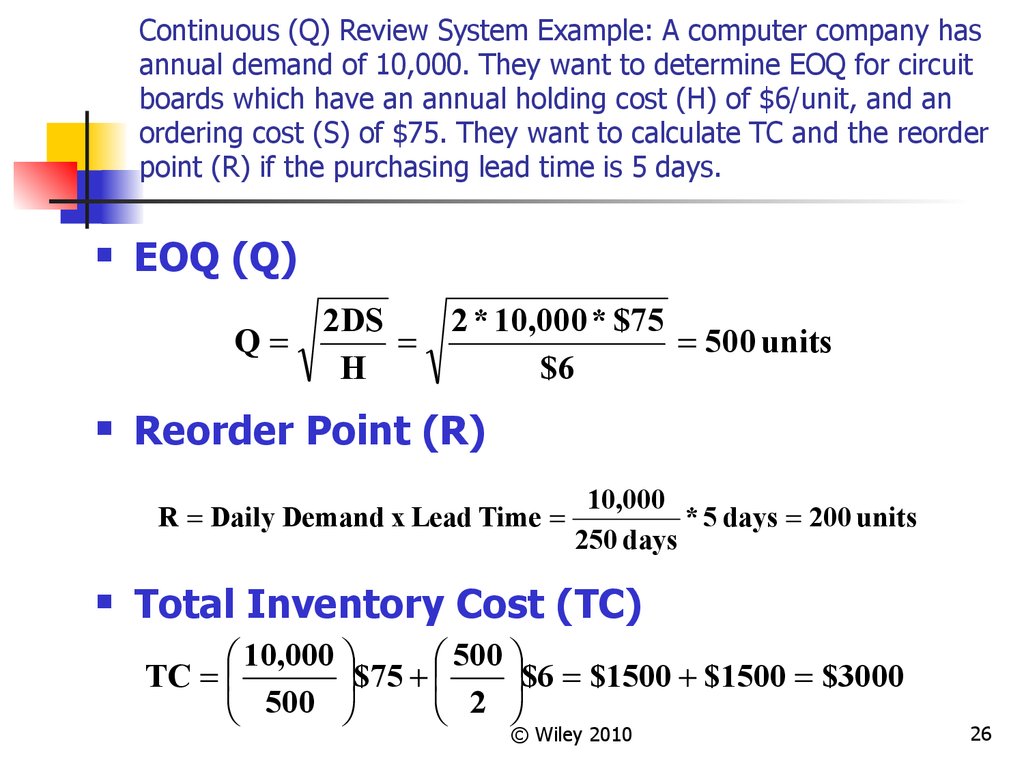

For example ABC is a retail company that purchases cloth from oversea and sell to the local customer. Food cost percentage formula. Youll need to know the lead time demand because thats how long youll have to wait before new stock arrives - youll want to have enough to satisfy your customers while you wait.

Jenny owns a grocery store where she has 2000 in. Calculate actual food cost for the week using the following food cost formula. Year 1 Quantity 100.

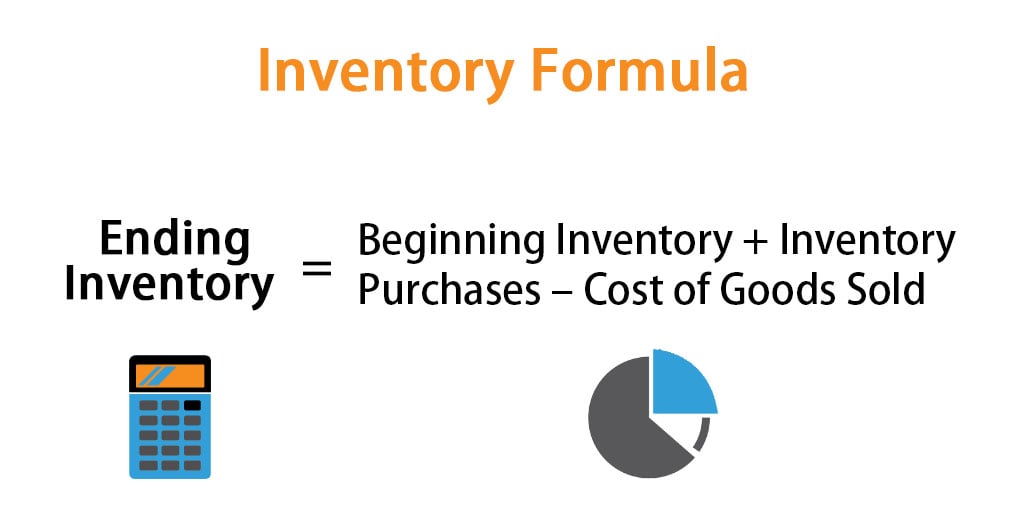

The first set of units purchased cost 10000 1000 x 10 and the second set of units purchased cost a total of 15000 1000 x 15 for a total of 2000 units and 25000 spent on new inventory. Your business has 10000 in inventory at the start of the year You buy 9000 in new products during the year. Actual Total Cost Available For Sale 384250.

That cost which do not change with the change in the level of production. Ch Cost to hold one unit inventory for a year. The unsold inventory represents the cash blocked which if not invested in buying inventories then could have generated a return at the rate of the cost of capital Cost Of Capital The cost of capital formula calculates the weighted average costs of raising funds from the debt and equity holders and is the total of three separate calculations weightage of debt multiplied by the.

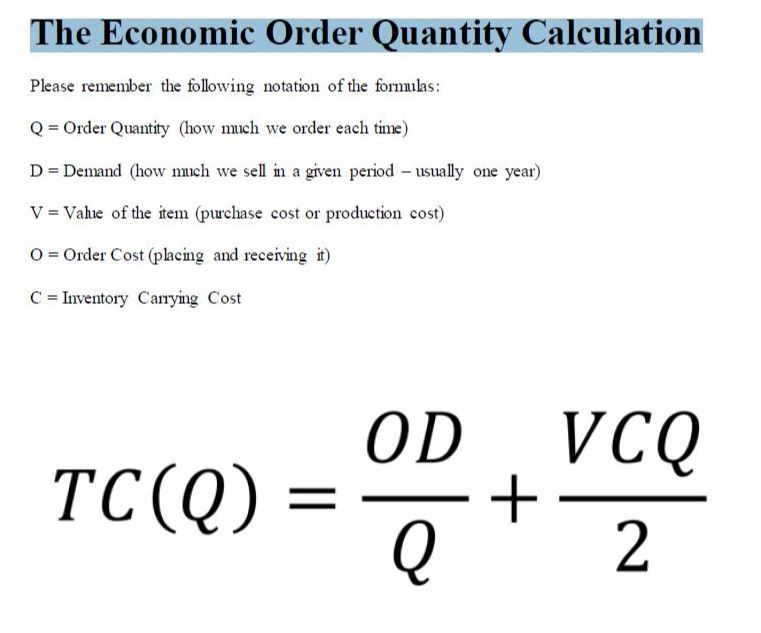

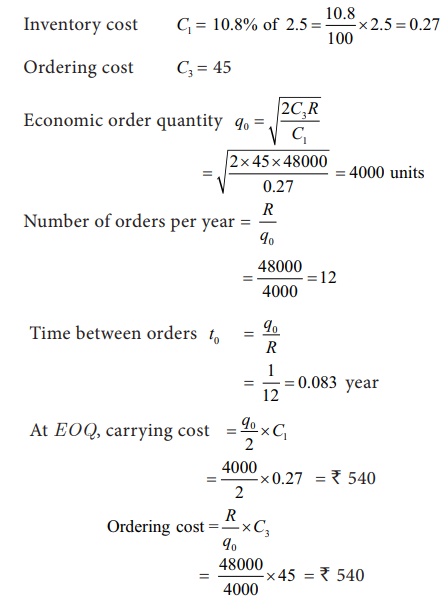

The formula for total cost can be derived by using the following five steps. Beginning Inventory 15000. Cp Cost to place a single order.

Food Cost Percentage Beginning Inventory Purchases Ending Inventory Food Sales. It includes cost price of the product paid to the supplier freight costs. Definition Average total assets are the assets used by businesses throughout the accounting period.

And youll need to know your safety stock because thatll protect you against any unexpected occurrences. At the end of the accounting period the company had 500 units left meaning it sold 1500 units. During the month ABC has the.

Check out the example below to see this food cost percentage formula in action. Inventory Management Models. Total Relevant Cost TRC Yearly Holding Cost Yearly Ordering Cost Relevant because they are affected by the order quantity Q.

The company purchases raw materials and uses labour to produce goods that it sells and the total value for the same is 5000. Lets see an example of the days in inventory formula. The dollar value of your sales for the week which you can find in your sales reports.

Average Cost per unit 3810 380 per unit 3 units 380 per unit 1140. Per Unit Product Cost Total Cost of Direct Materials Total Cost of Direct Labour Total Cost of Direct Overheads Total Number of Units. Total food sales.

This method can be applied to both manufacturing and trading company. Firstly determine the cost of production which is fixed in nature ie. Using Weighted Average Cost Ending Inventory Formula.

The weighted average cost per unit depends on the total cost and the total number of units. Heres what this formula looks like in practice. This figure is mostly used in calculating the activity ratio where revenue generated by the business is compared with the total assets implied.

To calculate the cost of goods sold use the following formula. Beginning inventory net purchases or new inventory - ending inventory COGS. Starting with the basics and then adding on the minute details in the formula are the way to go.

I t starts with determining the essential components that make up the Total Landed Cost. Determining whether your DIO is high or low depends on the average for your industry your business model the types of products you sell etc. Marginal Cost Change in Costs Change in Quantity Marginal Cost Example Calculation.

If the company sells two pairs of shoes to a customer who. Weighted Average Inventory Example. Together the COGS and the inventory valuations add up to the actual total cost available for sale.

Inventory Cost Flow Assumptions. Finally divide the result into your. For example a company buys pairs of shoes for 60 and sells each pair for 100.

Total Cost 38000 Explanation. However as soon as such goods are sold they become a part of the Cost of. Multiply the result by 365.

An inventory cost flow assumption is the method accountants use to remove their companys inventory costs and report them as cost of goods sold for accounting. Since the units are valued at the average cost the value of the seven units sold at the average unit cost of goods available and the balance of 3 units which are the ending Inventory cost is as follows. Suppose a company produced 100 units and incurred total costs of 20k.

Some examples of the fixed cost of production are selling expense rent expense. Divide cost of average inventory by cost of goods sold. To calculate your food cost percentage first add the value of your beginning inventory and your purchases and subtract the value of your ending inventory from the total.

So the cost of goods that are not yet sold but are ready for sale can be recorded as inventory asset in your balance sheet. To understand the maths behind our reorder point calculator lets break the formula down. Economic Order Quantity EOQ EOQ Formula.

Ending Inventory 16000. Lets take the example of company A which has a beginning inventory of 20000. Let us understand how to calculate the total landed cost of a particular shipment.

Independent Demand Inventory Management Prezentaciya Onlajn

Inventory Formula Inventory Calculator Excel Template

Chapter 12 Independent Demand Inventory Management Prezentaciya Na Slide Share Ru

Economic Order Quantity Eoq Applications Of Differentiation Maxima And Minima

No comments for "Total Inventory Cost Formula"

Post a Comment